the Search fund model

Search Funds are Our Preferred Channel to Invest in SMEs

![]()

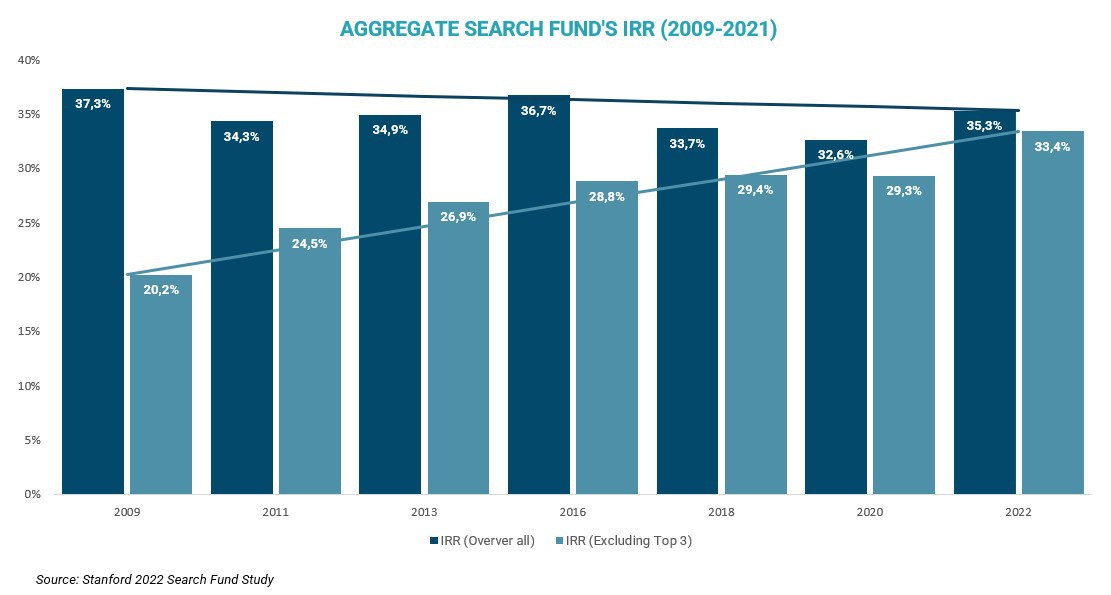

Search funds provide a unique opportunity for talented executives to acquire a company for them to run. They are also a perfect way to scale Private Equity investing in smaller deals and in complete alignment with the managers. Search funds have a track record of almost 40 years providing an average Internal Rate of Return above 30% with low variance and low correlation with economic cycles

The search fund model

Buy-out and Growth investments with a collaborative approach

A search fund is an investment vehicle through which investors financially support an entrepreneur’s efforts to locate, acquire, manage, and grow a privately held company

European SMEs

- 21.000 SMEs in Europe

- Exceptional track record

- Outdated management

- No succession plan

Sell with success, securing their legacy

Young Professionals

- Well-educated and experienced professionals with solid backgrounds

- Next challenge: becoming a businessman

High-potential operators aligned with carried-interest

Investors

- Diverse backgrounds & expertise looking for attractive investments

- Mentors and guidance

Buy companies at 20-30% discount securing a committed manager

European SMEs

- 21.000 SMEs in Europe

- Exceptional track record

- Outdated management

- No succession plan

Sell with success, securing their legacy

Young Professionals

- Well-educated and experienced professionals

- Solid backgrounds

- Next challenge: becoming a businessman.

High-potential operators aligned with carried-interest

Investors

- Diverse backgrounds & expertise

- Looking for attractive investments

- Mentors and guidance

Buy companies at 20-30% discount securing a committed manager

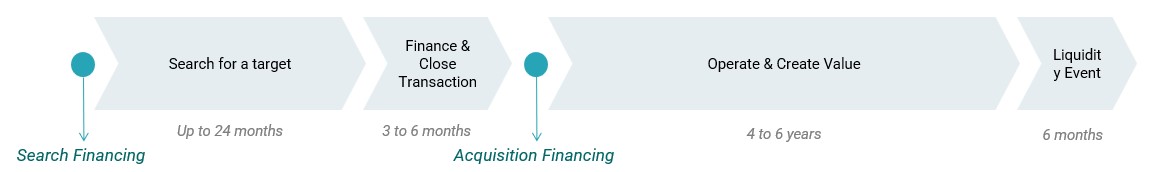

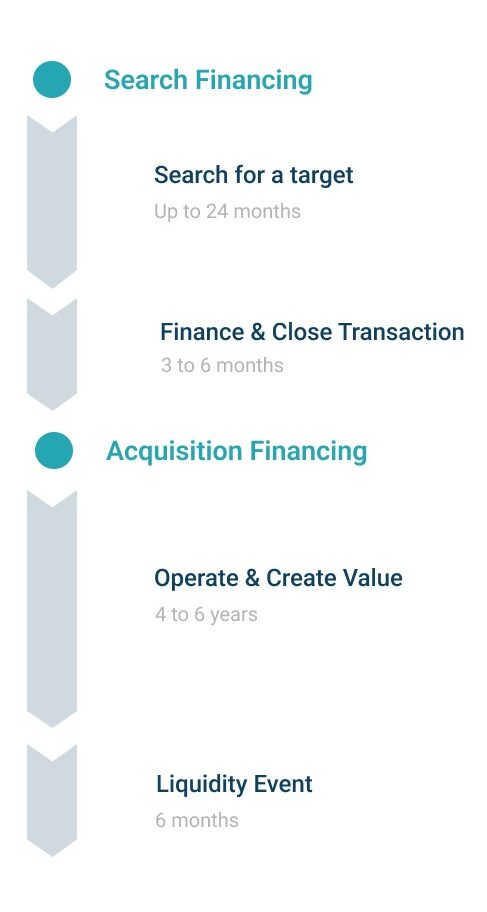

PHASES OF THE FUND SEARCH MODEL

TRACK RECORD

Almost 40 years yielding over 35% IRR

Search Fund acquisitions started in the US back in 1984 and have a history of 38 years track record.

- 66% of searches are successful in the US, 74% in Europe and RoW.

- 73% of search fund acquisitions generate capital gains, while most of the loss-making deals typically result in a partial loss only.

- Average investor returns in a Search Fund acquisition are 7.9x their initial investment over an average period of 7 years, a 36.8% annual return on investment.

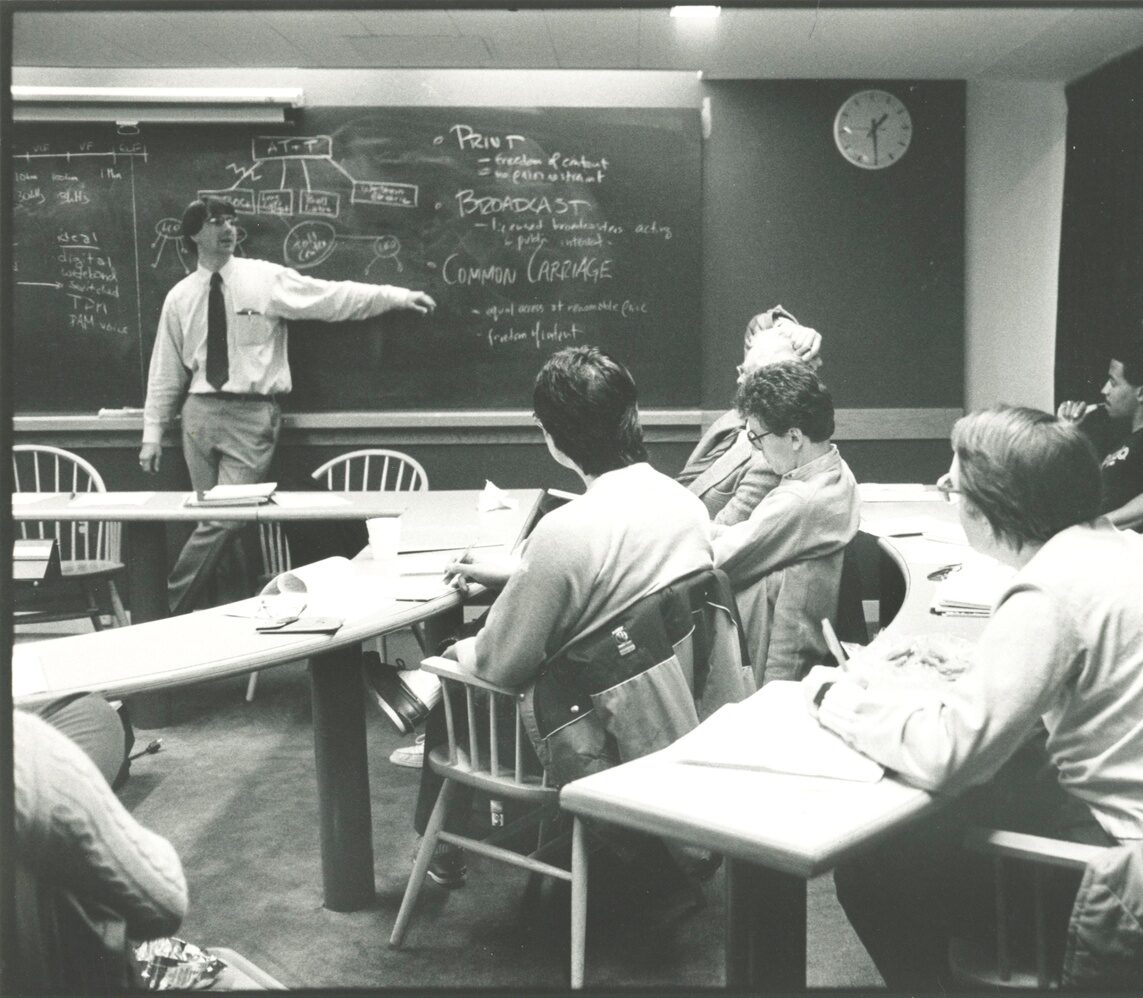

SUPPORTED BY TOP BUSINESS SCHOOLS

Model supported by reputable organizations

Renowned universities globally promote this career for young and talented individuals.

The model is supported by leading institutions such as Stanford University and IESE Business School, which conduct comprehensive research and closely monitor its development